Our Story

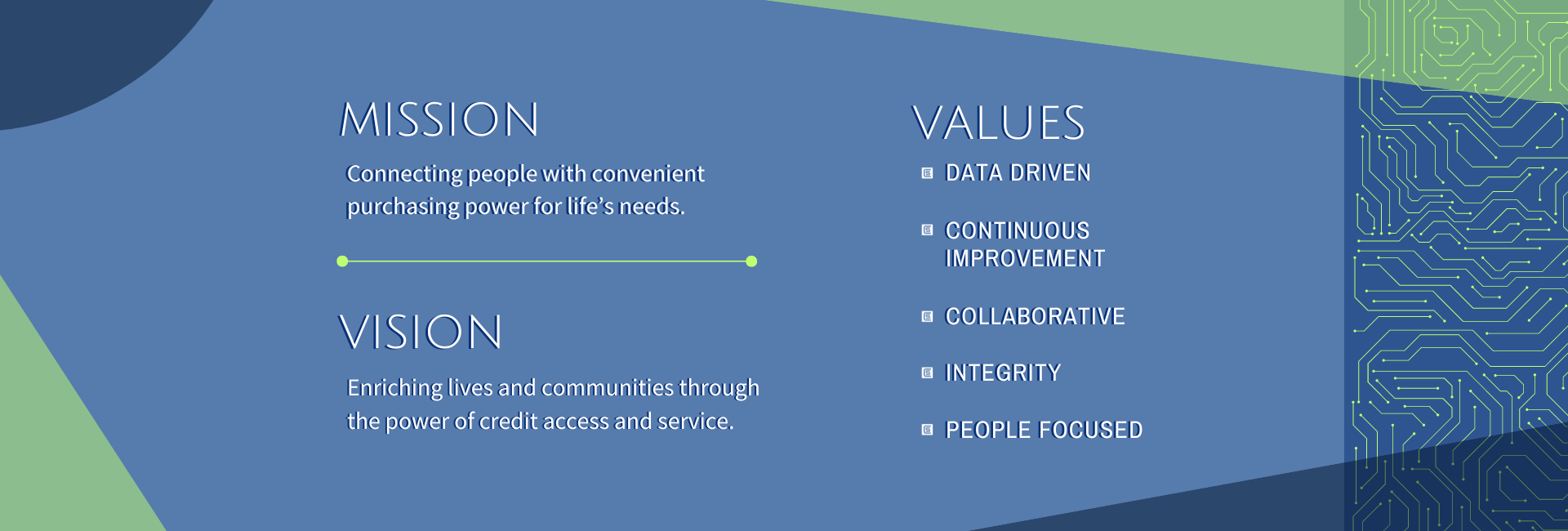

CAPITAL Services is an innovative credit card portfolio management and servicing company. We provide portfolio analytics, financial modeling, compliance, technology and servicing for our clients. Focused on generating sustainable financial strength, we are a family-owned business that was started in 1998.

Our company was built by executives with years of experience in the financial services and credit card industries and has grown beyond credit cards to include a full range of payment products and services.

Our Clients

Our Affiliates

CES provides valuable, consumer opt-in add-on products (card account payment protection and The PREMIUM Club for national deals and discounts) that financial institutions can implement within their card programs.

CES provides valuable, consumer opt-in add-on products (card account payment protection and The PREMIUM Club for national deals and discounts) that financial institutions can implement within their card programs.

CPC offers a number of funding alternatives for issuing card programs from agent bank relationships to participation in receivables ownership.

CPC offers a number of funding alternatives for issuing card programs from agent bank relationships to participation in receivables ownership.

CES provides valuable, consumer opt-in add-on products (card account payment protection and The PREMIUM Club for national deals and discounts) that financial institutions can implement within their card programs.

CES provides valuable, consumer opt-in add-on products (card account payment protection and The PREMIUM Club for national deals and discounts) that financial institutions can implement within their card programs.

CPC offers a number of funding alternatives for issuing card programs-from agent bank relationships to participation in receivables ownership.

CPC offers a number of funding alternatives for issuing card programs-from agent bank relationships to participation in receivables ownership.

Our Leaders

Alfred Furth has served as President & CEO of Capital Services since January 1, 2023. Alfred is a member of the Capital Board and serves as the President of the subsidiary, Capital Preferred Credit. Alfred joined Capital Services in 2007 as a Portfolio Analyst while he was completing his Doctorate in Computational Science and Statistics from South Dakota State University. Alfred played a critical role in building the data science and analytics area at Capital. Prior to his CEO role, he was appointed Vice President in 2011 and then Executive Vice President in 2020. His extensive knowledge and experience with analytical tools and techniques began during his tenure at the Mayo Clinic providing support to the Cancer Research Center.

Michelle Mueller joined Capital Services in April 2001. She provides strategy and leadership for various aspects of the business including financial reporting, analysis and controls; budgeting and forecasting; product marketing and development; and technology. She has over 25 years of experience in leadership roles and over 35 years of accounting experience. Michelle is a Certified Public Accountant and graduated from the University of South Dakota with a Bachelor of Science in Business Administration with an emphasis in Accounting. She is a Board member on the Board of Directors for Capital Services and the subsidiary Boards.

Sherry Tunender has been Senior Vice President of Compliance since 2011. Her responsibilities include oversight of the legal, compliance, audit, regulatory affairs, security risk, and internal control areas of the company. Sherry’s role at Capital Services is multi-faceted and backed by over 40 years of experience in the credit card industry. She is a Certified Regulatory Compliance Manager and serves as a compliance officer for Capital’s affiliate banks. She serves on the Boards of Directors for Capital Services, Capital Enhancement Services, and Capital Preferred Credit. She also serves as the President of our affiliate, Capital Enhancement Services.

Jeff Derner was part of the original Capital Services team from 1999-2005 and rejoined Capital Services in 2012. He is responsible for overseeing our customer contact centers including customer service, collections, agency management, mail operations, fraud, and correspondence. Jeff also manages the facilities department for our Sioux Falls and Brookings sites. He has over 25 years of experience in the financial services industry plus experience as a small business owner.

Jane Moore joined Capital Services in January 2005. She provides leadership and strategy for all Human Resources and Learning & Development activities including talent acquisition, employee relations and engagement, performance management, compensation and benefits, leadership and management training, occupational health, employment law, and regulation compliance. Jane has over 25 years of experience overseeing the delivery of human resource services. Jane received her Juris Doctorate and Bachelor of Science in Finance from the University of Nebraska-Lincoln.

Troy joined the Capital Services team in December 2020 as the Director of Information Security. In his current role, he manages the technology teams comprised of Information Security, Data Solutions, Software Development, Information Technology, and Project Management. He has over 30 years of experience deploying technology solutions in the financial services industry and has held key leadership positions in banking and fintech. He holds a degree in computer science and several industry certifications.

Vonnie Barnett joined Capital Services in 2010, and was named Vice President, Product Marketing and Development in 2020. In this role, she leads the business to business and business to consumer marketing activities. In addition to her prior financial services experience, Vonnie held marketing or administrative positions for mining, manufacturing, vending, and non-profit organizations. She received her Bachelor of Science degree in Business Administration from Northern State University.

Steven Mandsager joined Capital Services in 2007 as a Finance Analyst. During 2011 – 2019, he transitioned into Management and Director roles, leading up to his current role as VP of Finance in 2022. Steve received his bachelor degree from Augustana University in Business Administration and his MBA from University of MN - Carlson School of Management. Steve brings over 20 years of finance and industry-related experience to Capital and oversees the Finance team. He serves as a Portfolio Committee member within the organization. During Steve’s tenure at Capital, he introduced several initiatives offering visibility into credit card performance, long-term value, and successful credit pricing opportunities.